Smash The Status Quo With These 10 Powerful Finance Podcasts

Ever feel like you need a crystal ball to understand what’s going on in the markets?

As 2020 stumbled, drunk, over the finish line, the absolute wreckage of the economy was overshadowed. The massive rebound in the stock market was in every media outlet. As if that obnoxious year couldn’t get worse, now we’re supposed to understand what a K shaped recovery is?

Retail investors on Reddit struck back. And gained the ally-ship of some of Silicon Valley’s biggest activist investors. Not to mention eccentric entrepreneurs.

The entire financial system, just a decade or so out from a complete bailout is poised for disruptive democratization. This is no time to sit out on the sidelines.

Well, I Do Disclaim…

Now, as an enormous disclaimer that shouldn’t need saying, but it does. I am not a lawyer or a financial adviser. Nothing in this article is legal or investment advice.

What we are, at Discover Pods, is passionate about podcasts and how they can improve our lives. Learning a little something about the markets, how they work, and what’s going on falls squarely in that category.

So let’s look at some of the best finance podcasts to gain a better understanding of what can be alien territory.

Marketplace

Hosted by Kai Ryssdal, Marketplace bills itself as the show that makes sense of the day’s financial news. It’s a show designed for the widest possible audience. You don’t need to have a background in economics for this show to be illuminating.

Kai’s team provides economic context through interviews, conversations, and short stories. They aim to make the dry numbers more digestible.

Marketplace is the flagship show, but there is actually a suite of financial podcasts under the Marketplace umbrella:

- Marketplace Morning Report

- Marketplace Weekend

- Marketplace Tech

- Marketplace Minute

Apple Podcasts | Stitcher | Spotify

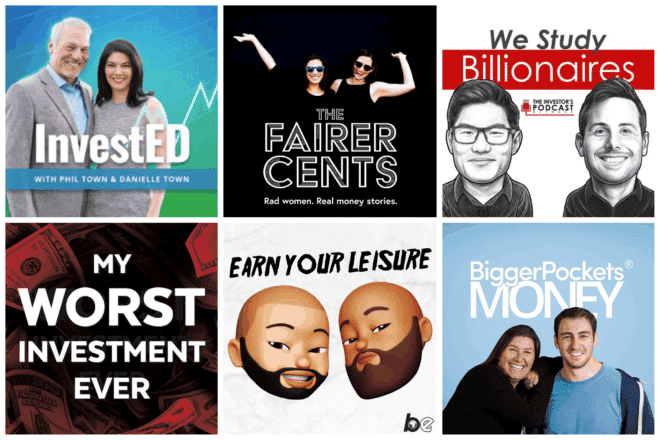

Bigger Pockets Money Podcast

I actually came across the Bigger Pockets Money Podcast after having listened to their sister show, Bigger Pockets, for years. That show focused on real estate investing.

Bigger Pockets Money centers around wealth creation. How to build it. How to keep it.

As hosts, Mindy Jensen and Scott Trench run through a wide range of topics. They cover leverage, financial independence, and debt structure. To name a few. They also bring on guests and share stories that are down right inspirational.

They spotlight stories that are accessible enough to show their listeners what’s possible. Nothing’s guaranteed, but the the possibility alone…

It’s worth a listen.

Apple Podcasts | Stitcher | Spotify

The Fairer Cents

It may seem like “the market” exists separate and apart from our everyday lives. Something only the experts can understand and only for professionals. But that’s just the way the patriarchy wants it.

There’s a reason the Fairer Cents was named one of the 8 best finance podcasts of 2020. Hosts Kara Perez and Tanja Hunter take a holistic approach to disrupting the finance world’s male dominant status quo. They do so by demystifying the financial universe.

Perhaps even more important, they peel back the covers on systemic roadblocks in the market. Roadblocks like privilege, the silent costs of motherhood, and the very definition of success itself. Blocks that can stymie real wealth creation.

It’s an absolute must listen.

Apple Podcasts | Stitcher | Spotify

Earn Your Leisure

We are a culture and economy fueled by debt. Lending rates have been under 5% since 2007. The average American carries $90,460 in debt.

“Investing” then, isn’t something accessible for the average person. Financial adviser Rash Bilal and educator Troy Millings set out to change that basic premise. The through line of their finance podcast is practical, casual, advice on how to acquire more assets than you have liabilities.

That’s wealth creation. That’s the liberating mindset shift they seek to foster in their listeners. We should all be listeners.

Apple Podcasts | Stitcher | Spotify

Stacking Benjamins

The first thing you’ll notice about Stacking Benjamins is the humor. The topic can be a little dry but the Stacking Benjamins crew attack these heady topics with an authentic wit that screams trustworthy.

Recording from host Joe’s Mom’s unfinished basement doesn’t hurt the levity factor either.

But the show’s goal is serious. Stacking Benjamins isn’t so much a show about definitive answers. No, there are plenty of those. It’s more a show that ensures their audience knows how to ask the right financial questions. It’s about opening doors instead of standing as gatekeepers.

They also happen to be very active on Twitter (@SBenjaminsCast). You should say hi.

Apple Podcasts | Stitcher | Spotify

The Motley Fool

Like Marketplace, the Motley Fool is actually a stable of related podcasts. But with more focus on investing and without the NPR vibe.

The Motley Fool was founded by two brothers, Tom and David Gardner as a stock picking service for outsiders. As time has progressed, so has the fool.

Their podcast silo now has 5 different shows:

- Motley Fool Money

- Market Foolery

- Rule Breaking Investors

- Motley Fool Answers

- Industry Focus

Each show has its own focus but starting with Market Foolery finance podcasts is probably your best primer. It covers current events and the day’s news from a finance perspective.

Apple Podcasts | Stitcher | Spotify

We Study Billionaires

If you’re going to disrupt a status quo, you kinda need to have an idea of what you’re disrupting right? That’s where the We Study Billionaires comes in.

It interviews some of the most successful investors around. As well as looks at the most prolific investing philosophies. If you want to know why things are done the way they’re currently done, this pod is a good place to start.

All the information covered on WSB serves as a solid investing foundation.

Apple Podcasts | Stitcher | Spotify

InvestED

Phil Town is a hedge fund manager and financial adviser. As the host of one of the most well reviewed financial podcasts, you might expect him to have some stodgy elitism about him. His co-host, who also happens to be his daughter, dispels any such expectation.

Their show is readily accessible to the average listener and beginning investor. But they don’t pull punches or skimp on the details. Phil and Danielle cover their topics in depth and with enough clarity to say that they are really educating their listeners. They aren’t merely having a conversation about the nuts and bolts. They make sure to bring their audience along.

If you are just getting into the market, I recommend their episode on making your first trade. It’s an exciting first step and it feels like Tom and Danielle are making it with you.

Apple Podcasts | Stitcher | Spotify

My Worst Investment Ever

Example is a powerful learning modality. Not only is learning from the mistakes of others useful, but it is also cathartic. It’s encouraging to hear the trials and tribulations overcome to build back after defeat.

That’s what “My Worst Investment Ever” is all about. The recounting of accounts that shocked their accountants.

Apple Podcasts | Stitcher | Spotify

Pivot

Pivot is a collaboration between hosts Kara Swisher from Recode and Scott Galloway, an NYU professor as well as host of his own eponymous show.

Pivot is ostensibly a news/commentary show. What sets it apart is Swisher and Galloway. They riff on subjects that sit at the intersection of finance, public policy, and tech. And have the bona fides to back it up.

There’s a macro economic as well as mass psychological component to understanding what’s taking place in the market. The underlying forces usually live in the overlap in Pivot’s subject.

If you’re looking for a smart, high level, view of market trend lines, Pivot should find its way to your queue.

Apple Podcasts | Stitcher | Spotify

Conclusion

Some not insignificant changes are coming to the way we trade and how society interacts with markets. There has been inequity and pressure from every interested side here. Something has to give.

What change is coming? That’s murkier.

What’s clear is that understanding the basics and being aware of what’s going on will pay dividends. These financial podcasts go a long way towards getting us up to speed. Is there anything podcasts can’t help with?

If you love podcasts as much as we do, give us a follow on Twitter.

1 comment

Pingback Podcast Spotlight: #ElderWisdom | Stories From The Green Bench Podcast | Discover the Best Podcasts | Discover Pods

Comments are closed.